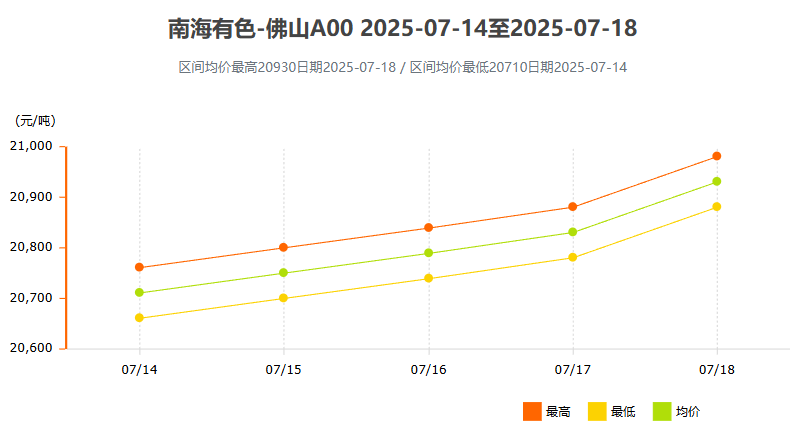

As of July 18th this week, the average price of aluminium was 20930 yuan per ton, decrease of 110 yuan per ton compared to last week.

Nanhai Nonferrous Metals – Foshan A00 Market Trend

(Data source: worldal.com)

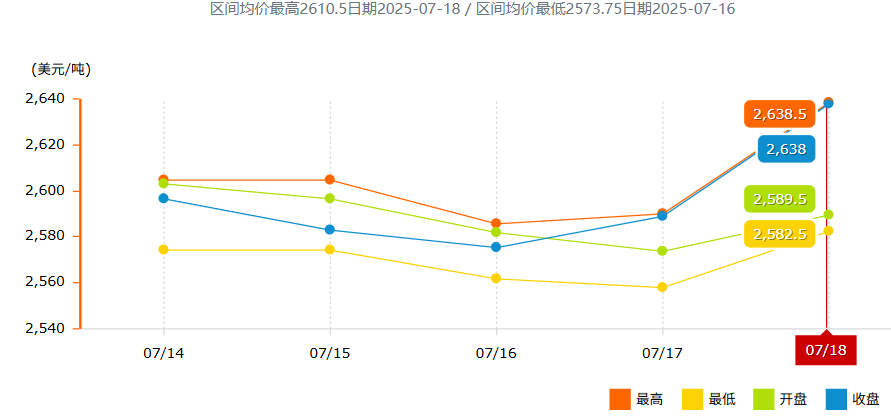

AHD Market Trend

(Data source: worldal.com)

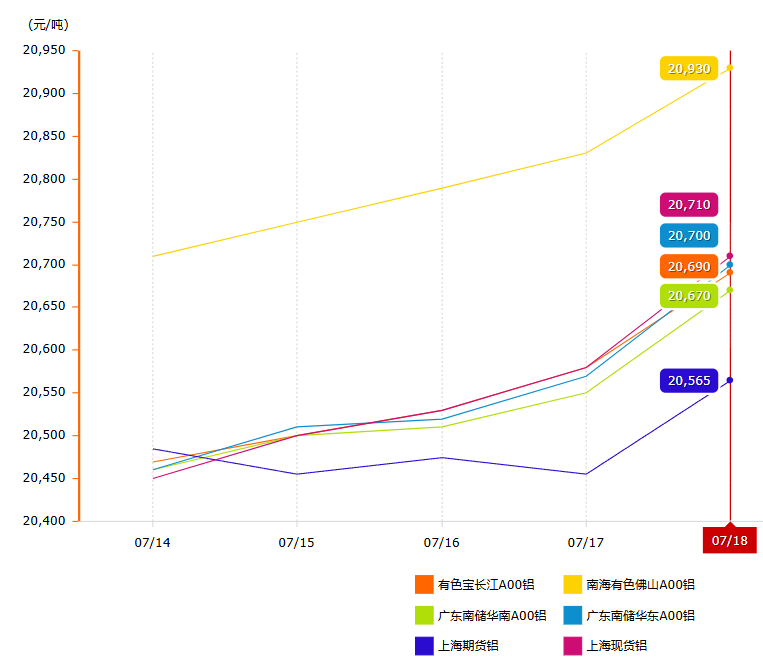

The market situation of aluminium

(Data source: worldal.com)

On the supply side: By 2025, the domestic alumina production capacity had exceeded 110 million tons. The output in the first half of the year increased by 8.5% year-on-year to 43.68 million tons. It is expected that there will be an excess of 1.46 million tons for the whole year. The concentrated release of new production capacity in Shandong, Guangxi and other places has pushed the national operating capacity to 88.57 million tons per year, but the operating rate has dropped to 79.97% due to weak demand. On July 17th, the domestic operating capacity of alumina in the first ten days of July increased by 37000 tons compared with the previous month to 1.785 million tons, reaching a new high for the year. The capacity utilization rate rose to 85.3%. Moreover, Guinean mining enterprises are expected to resume production, and imported alumina will also arrive at the port in July, causing significant pressure on the supply side.

On the demand side: On July 14th, the operating rate of downstream electrolytic aluminium was close to the ceiling. Although the operating capacity increased slightly, the consumption of alumina remained stable with a slight increase. However, the subsequent growth space is limited and it is difficult to support a significant price increase. On July 17th, the social inventory of electrolytic aluminium remained at a high level. Some aluminium plants began to reduce production due to compressed profiles, and their purchase volume of alumina decreased. Meanwhile, aluminium processing enterprises are in the off-season, with orders decreasing. The operating rate of profile factories has dropped to 55%, and the demand for non-metallurgical grade alumina has also shrunk. The overall demand side is unable to support the price of alumina.

Factory warehouse and delivery inventory: The warehouse receipt inventory of the Shanghai Futures Exchange has maintained a low downward trend. As of July 15th, the registered warehouse receipt volume was 124000 tons. Aladdin data on July 15th showed that the inventory in the delivery warehouse increased slightly but remained at a relatively low level for the same period in history, and the liquidity of the spot market supply was relatively controllable.

Port inventory: On July 16th, port inventory rose to 423000 tons. Low-priced goods from overseas flooded in, and the import volume increased by 30% compared with the previous period. The market supply was clearly oversupplied.

Raw material inventory of electrolytic aluminium plants: According to SMM, the weekly inventory of alumina in electrolytic aluminium plants accumulated by approximately 22000 tons in the first ten days of July compared with the previous period.

In the first ten days of July, the domestic operating capacity of alumina increased by 37000 tons compared with the previous month to 1.785 million tons, reaching a new high for the year. The corresponding capacity utilization rate rose to 85.3% (the data is as of the data disclosure of the China Nonferrous Metals Industry Association on July 17th, reflecting the start-up situation of that week and the previous period). This level has risen compared to last month, mainly due to the recovery of some previously maintained production capacity and the release of new capacity.

The delay in the completion cycle of the real estate industry and the slowdown in the growth rate of demand for automotive lightweight have led to a year-on-year decline in orders for architectural profiles and automotive aluminium. Data on July 17th showed that the social inventory of electrolytic aluminium remained at a high level. Downstream purchases were mainly for essential needs, with speculative demand lacking. The processing fee for aluminium rods remains at a low level (the spot price of first-grade alumina in Foshan area has expanded to 50-100 yuan per ton), reflecting insufficient willingness of terminal customers to accept goods.

Guinea’s bauxite is facing supply risks. In May 2025, the Guinean government revoked 51 mining licenses, involving a bauxite production capacity of 40 million tons, accounting for 12% of its total capacity. In July, Guinea’s Minister of Mines, Bouna Sylla, announced that 50% of bauxite exports must be transported by vessels flying the Guinean flag and a state-owned shipping company must be established. As a matter of fact, the Guinean government intends to force domestic industrialization (reduce raw ore exports) through the recovery of mining rights and then strengthen control over the supply chain through shipping monopolies.

Typhoon Wipha is expected to make landfall on July 21st. Ports west of the Pearl River Estuary (such as Guangzhou Port and Zhanjiang Port) will suspend operations for 2 to 3 days, and all passenger ships in the Qiongzhou Strait will be suspended.

This will directly affect the arrival rhythm of imported aluminium ingots at the port. Coupled with the disruption of railway transportation in the South China Sea area, it is expected that the spot circulation volume will decrease next week.

If the volume of spot goods in circulation drops in the short term and downstream enterprises have a rigid demand for replenishment, a short term and downstream enterprises have a rigid demand for replenishment, a short-term pattern of “supply falling short of demand” will be formed,which will push traders to raise prices and make spot prices more likely to rise than fall.

Once the weather improves, the suspended ports and logistics will gradually resume operations, and the previously accumulated aluminium ingots will be concentrated in the market, which may lead to the accumulation of regional inventory for express delivery. At this point, the prices that were previously supported by transportation disruptions will come under pressure due to the return of supply, and may even experience a correction.

In terms of operation, it is necessary to closely monitor the path of the typhoon, the duration of the suspension of services and subsequent inventory changes. If the transportation disruption exceeds expectations (such as the port being suspended for more than 5 days), a short-term bullish outlook can be considered. If the impact fades rapidly, be vigilant against the risk of a price correction.

On a macro level, the strengthening of the US dollar and the easing of tariffs are in a game of strategy, while the accumulation of fundamental inventories dominates the price direction. It is expected that the aluminium ingots in the South China Sea will fluctuate weakly next week. It is recommended to pay close attention to the rhythm of inventory accumulation and the supply risk from Guinea.

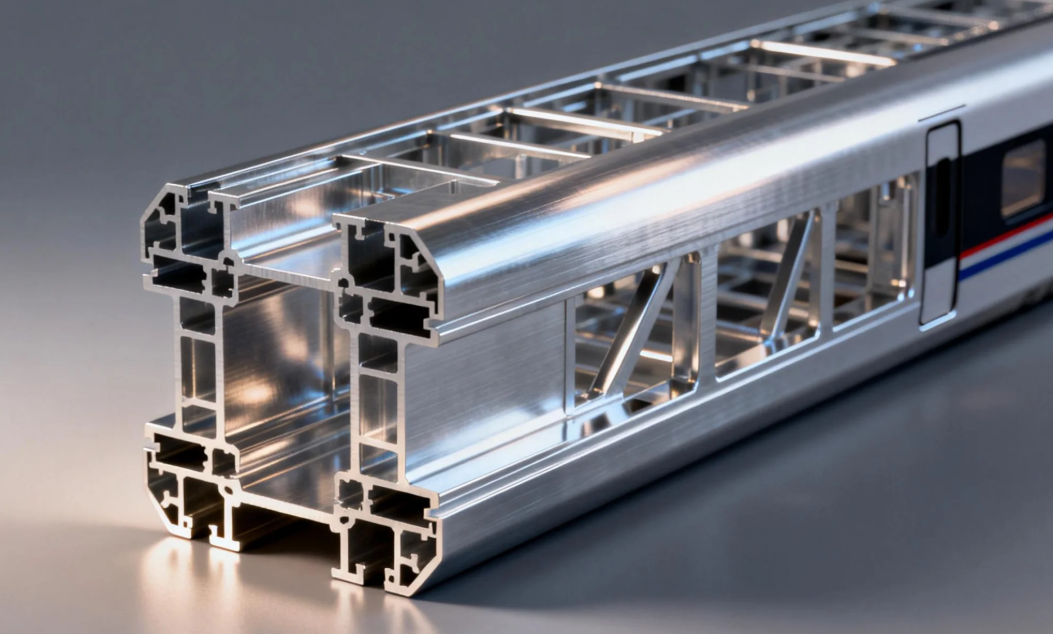

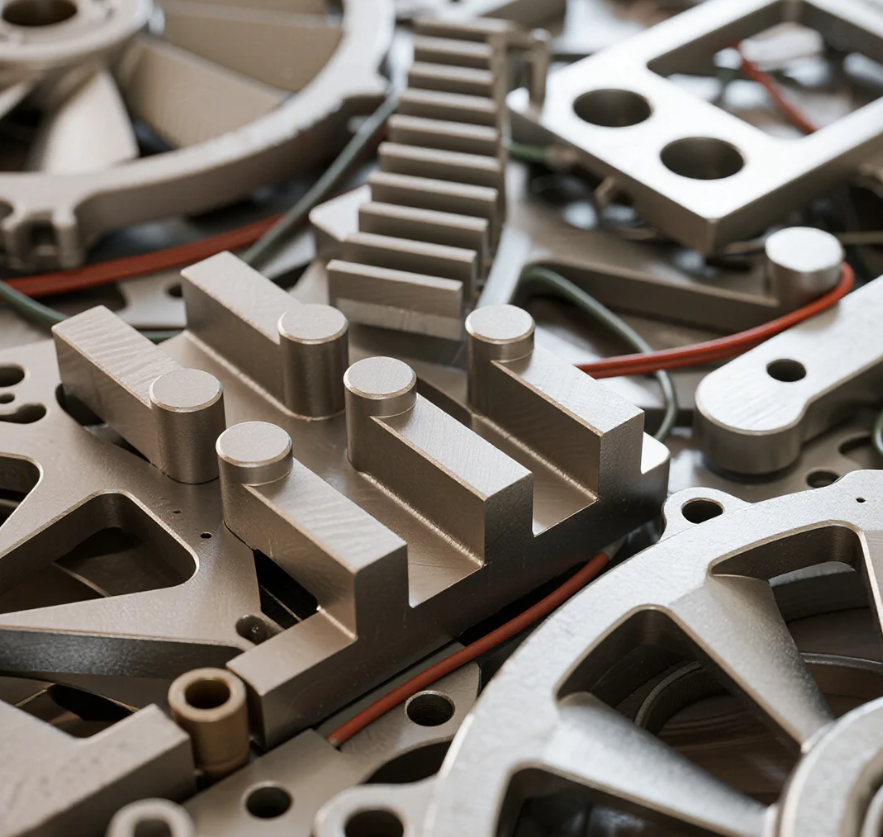

The advantages of using aluminium alloy for the main structure of high-speed train carriages

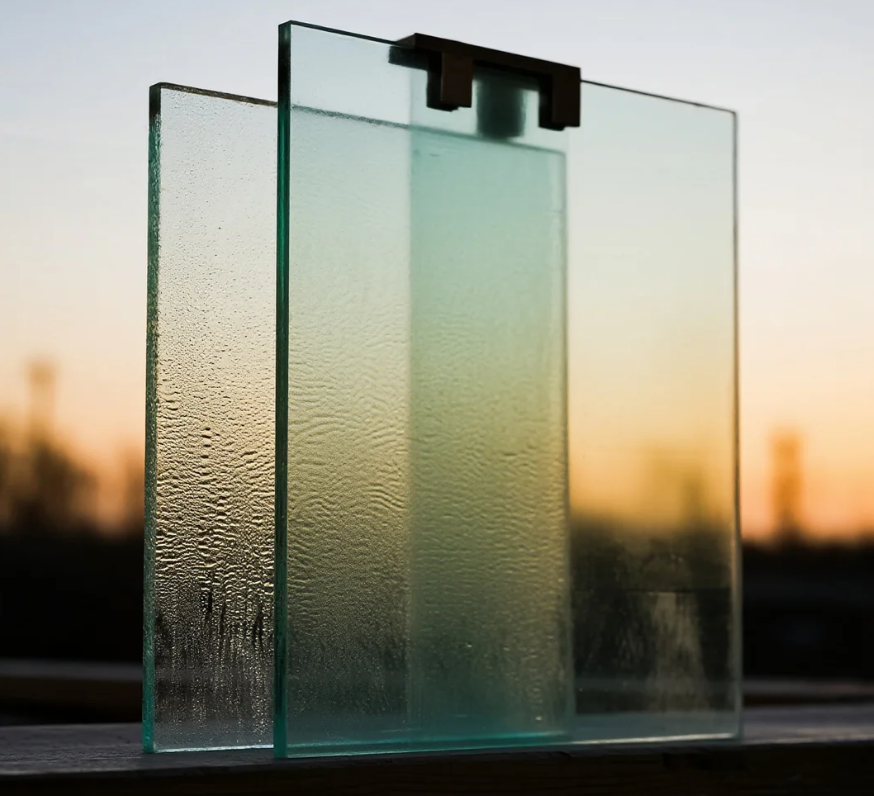

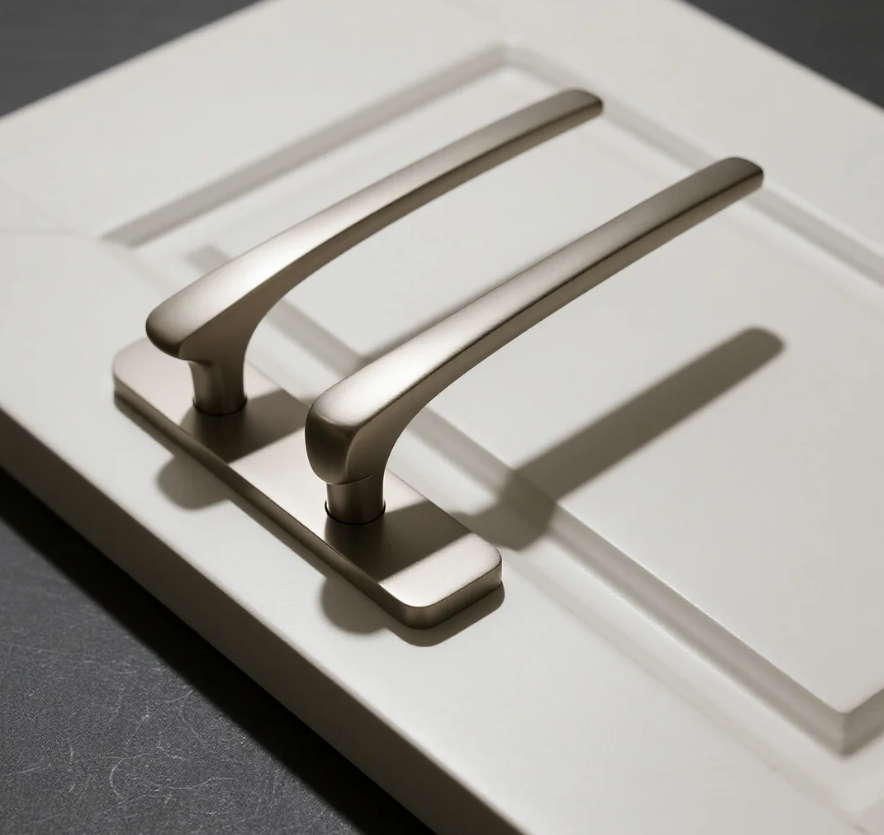

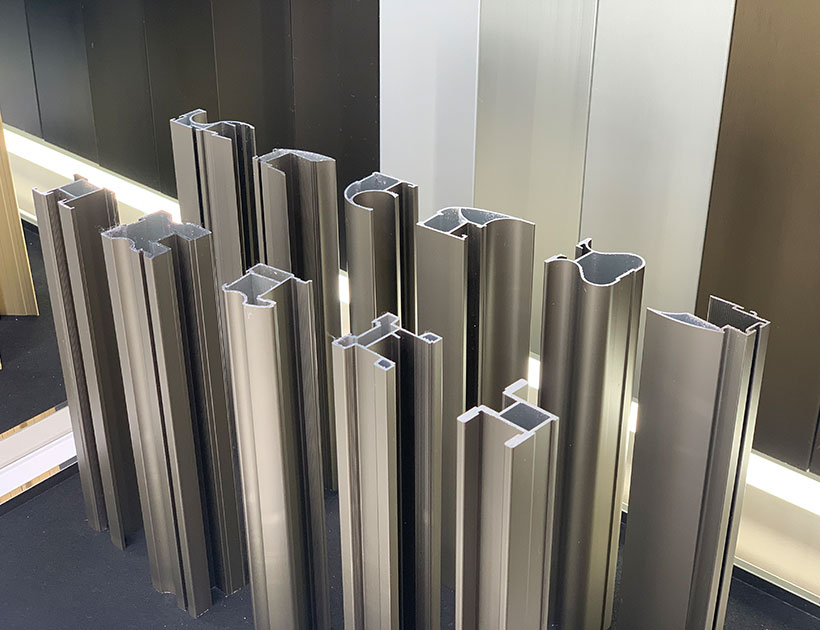

Methods for distinguishing Indoor and Outdoor Aluminium Doors

Maintenance methods and tips for aluminium doors and windows

Characteristic of outward-opening and hung aluminium windows

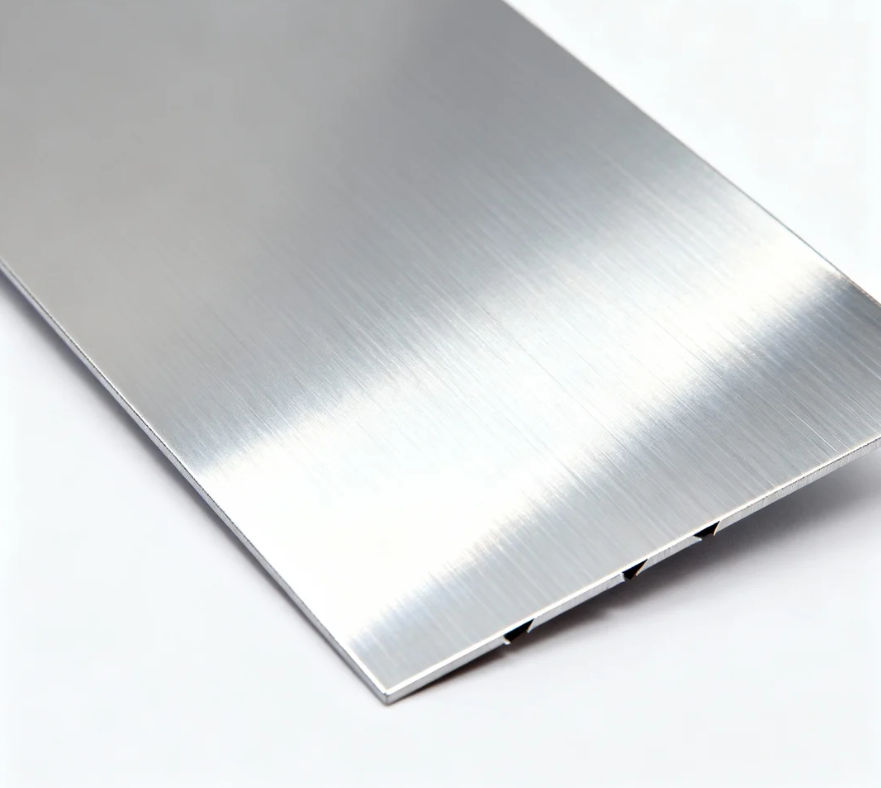

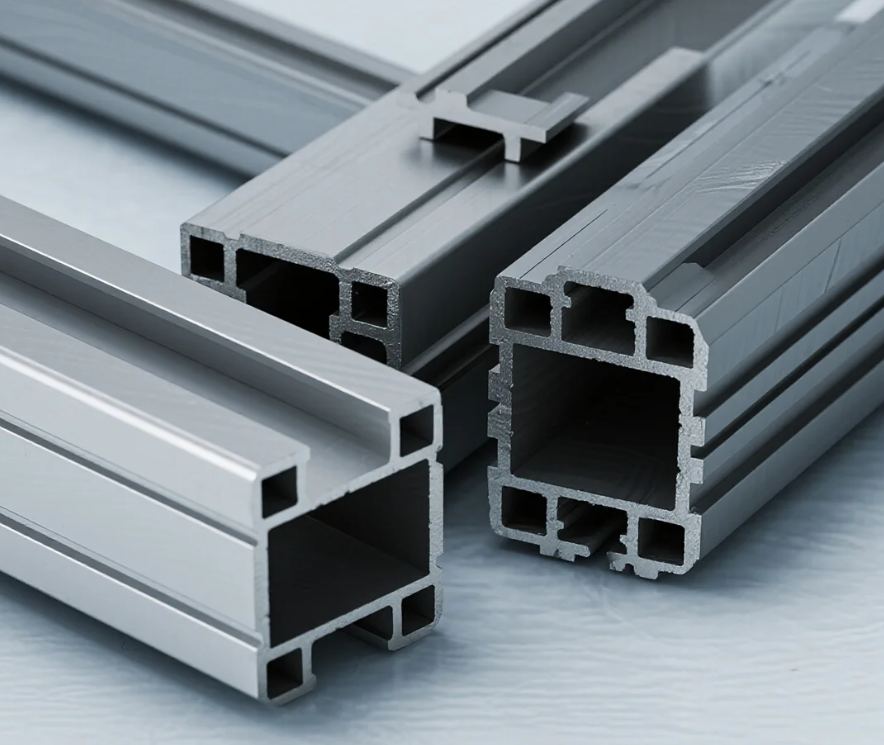

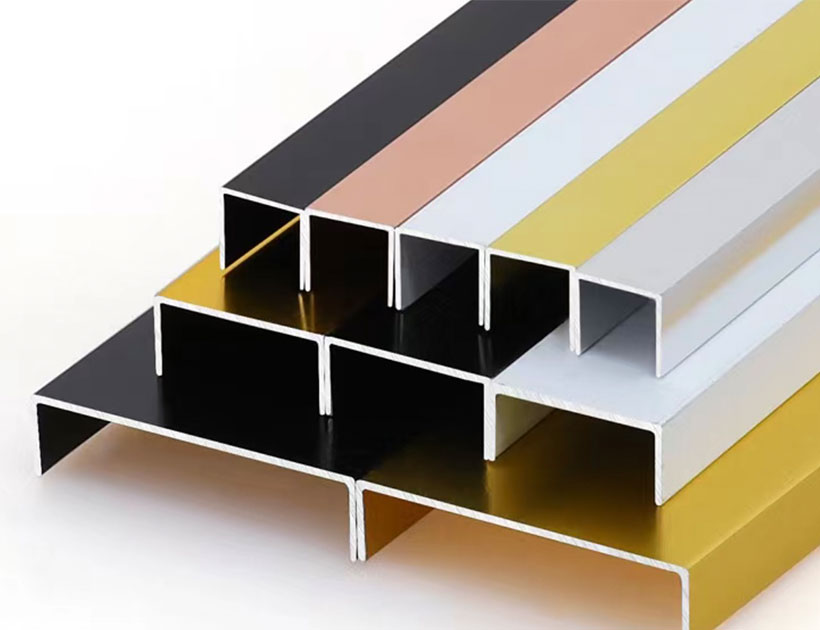

Seven Benefits Of Using Aluminium Profiles In Curtain Wall Systems

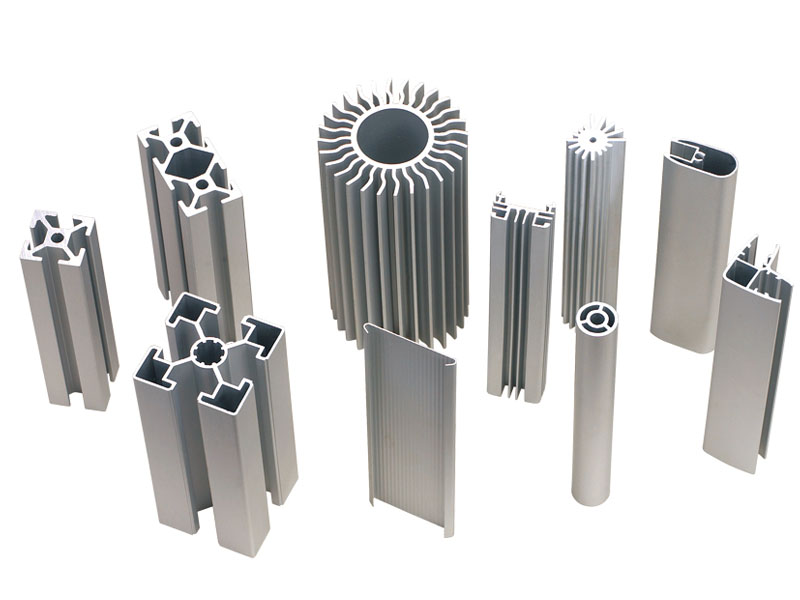

The Application of Aluminium Profiles in New Energy Vehicles

The Composition and Application of Series 6 Aluminium Alloys

Top 5 Benefits of Using LED Aluminium Profiles in Modern Lighting

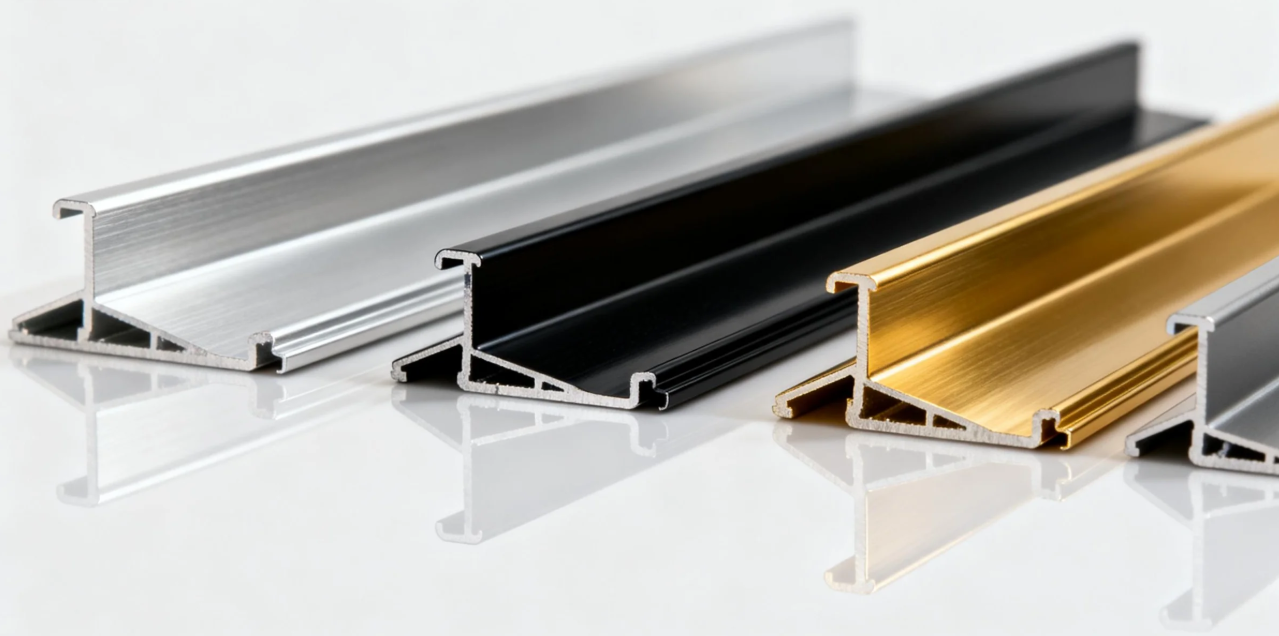

A Complete Guide to Aluminium Frame Profiles for Modern Structures

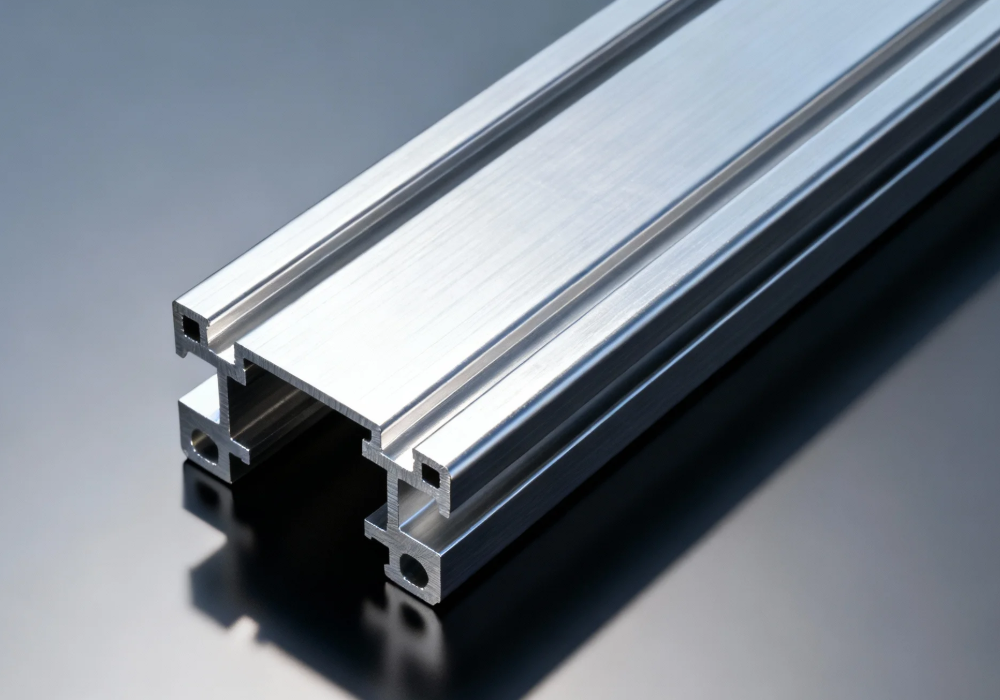

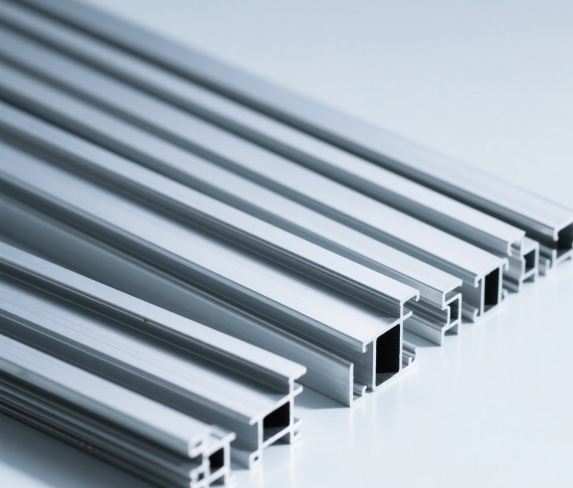

Exploring the Strength and Versatility of Aluminium Extrusion Profiles

How to Choose the Right Aluminium Profile Supplier for Your Project